Contents

Introduction to ABC Pattern .328 1.27

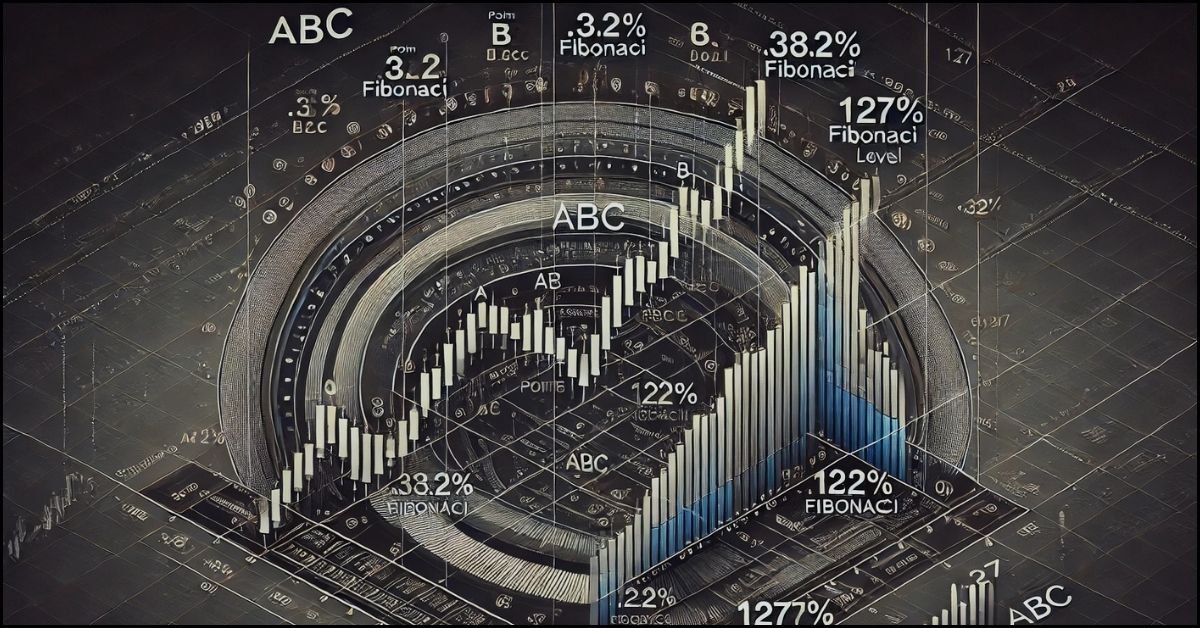

The trading world has various strategies and technical analysis tools to predict market movements. One such tool is the ABC Pattern .328 1.27, which has gained popularity among traders for its effectiveness in identifying potential reversals and trade opportunities. In this article, we’ll utilize the ABC pattern .328 1.27 for better trading results, offering insights into its formation, application, and best practices for maximizing its potential.

Understanding this pattern can significantly enhance your trading strategies, whether you are a beginner or an experienced trader.

What is the ABC Pattern .328 1.27?

The ABC Pattern is a classic chart pattern used in technical analysis to spot trend reversals or corrections. The .328 1.27 variation of the ABC pattern is a specific ratio that aligns with Fibonacci retracement and extension levels, making it a reliable tool for traders. Here’s a deeper look into the pattern:

Understanding the ABC Structure

The ABC pattern consists of three prominent swings:

- Point A to B: The initial move in one direction, either up or down.

- Point B to C: A retracement from the original move.

- Point C to D: A continuation in the direction of the original move.

In the .328 1.27 variation, the pattern aligns with specific Fibonacci levels. Point B represents a 38.2% retracement from the initial move (A to B), and Point D extends to the 127% Fibonacci level from Point C. This Fibonacci relationship helps traders identify potential entry and exit points.

Significance of .328 and 1.27 Ratios

- .328 Retracement: This Fibonacci level signifies a moderate pullback from the primary trend, indicating a potential continuation.

- 1.27 Extension: This level suggests a more robust continuation, signaling that the trend will likely persist beyond this point.

Understanding these ratios is crucial for traders who wish to use this pattern effectively, as they provide specific entry and exit signals.

How to Identify the ABC Pattern .328 1.27 on Charts

Identifying the ABC pattern .328 1.27 on trading charts requires a keen eye and understanding of price movements. Here’s how you can locate it step-by-step:

Step 1: Recognize the Initial Move

Begin by identifying the A to B move, which represents a significant price movement, either upward or downward. This is the starting point of the ABC pattern.

Step 2: Measure the Retracement

The next step is to identify the B to C retracement. Use the Fibonacci retracement tool to measure this move. If the retracement reaches around the 38.2% level, it confirms the .328 retracement of the pattern.

Step 3: Project the Extension

Finally, the Fibonacci extension tool projects the C to D move. The 1.27 extension level is the target point where the pattern completes, indicating a potential reversal or continuation of the trend.

Practical Tips for Identifying the Pattern

- Use candlestick patterns to enhance the accuracy of identifying the ABC pattern.

- Confirm the pattern with volume analysis, as solid volume often supports trend continuation.

- Apply this pattern across different timeframes to ensure validity in various trading scenarios.

How to Trade the ABC Pattern .328 1.27

Once you have identified the ABC pattern, the next step is to trade it effectively. Here are the trading strategies to consider:

Entry Strategy

- Buy/Sell at Point C: Once the retracement reaches the .328 level, look for entry opportunities around Point C.

- Confirmation Indicators: To confirm the entry, use additional indicators like the RSI (Relative Strength Index) or MACD (Moving Average Convergence Divergence).

Exit Strategy

- Target Point D: Set your target at the 1.27 extension level to ensure you capture the move’s full potential.

- Trailing Stop Loss: To manage risks, use a trailing stop loss to lock in profits as the price approaches the 1.27 level.

Risk Management Techniques

- Set Stop Loss Below Point C: For buy trades, place a stop loss just below Point C to minimize potential losses.

- Adjust Position Size: Use proper position sizing to manage risks effectively and ensure your account doesn’t over-leverage.

This trading strategy allows for precise entries and exits, reducing the risk of unexpected price reversals.

Common Mistakes When Using ABC Pattern .328 1.27

Like any trading strategy, the ABC pattern .328 1.27 has potential pitfalls. Here are some common mistakes traders make and how to avoid them:

Ignoring Market Context

The ABC pattern is not foolproof; it works best when used in conjunction with overall market trends and sentiments. Don’t rely solely on the pattern for trading decisions—consider other factors like economic news, market trends, and volume.

Overlooking Stop Losses

Failure to use stop losses can lead to significant losses, especially in volatile markets. Always set a stop loss below Point C to protect your trades from sudden reversals.

Misinterpreting Fibonacci Levels

Sometimes, traders misidentify the .328 retracement or 1.27 extension due to incorrect chart analysis. Use accurate Fibonacci tools and verify the levels before making trading decisions.

Practical Solutions

- Backtest the pattern before using it in live trading to understand its success rate.

- Combine with other technical indicators for better accuracy and confirmation.

FAQs

How reliable is the ABC Pattern .328 1.27 for trading?

The ABC pattern .328 1.27 is highly reliable, especially when confirmed with other indicators like RSI, MACD, or moving averages. However, its success depends on the overall market context and trading strategy.

What timeframes work best for the ABC pattern .328 1.27?

The pattern works well on multiple timeframes, including hourly, 4-hour, and daily charts. It’s most effective when used in higher timeframes, providing more accurate signals.

Can beginners use the ABC Pattern .328 1.27 effectively?

Yes, beginners can use this pattern, provided they understand Fibonacci retracement and extension levels. It’s advisable to practice identifying and trading the pattern in a demo account before applying it to actual trading.

What are the key indicators to use with the ABC Pattern .328 1.27?

Key indicators include RSI, MACD, moving averages, and volume. These indicators help confirm the pattern and increase the accuracy of entry and exit points.

Is the ABC Pattern .328 1.27 suitable for all markets?

It is suitable for all markets, including forex, stocks, and cryptocurrencies. However, its effectiveness varies depending on market conditions, so adapting the strategy accordingly is crucial.

How can I minimize risks while trading the ABC Pattern .328 1.27?

Minimize risks using stop losses, proper position sizing, and trading only when the pattern aligns with other technical indicators and market trends.

Conclusion

The ABC Pattern .328 1.27 is a powerful tool in a trader’s arsenal, offering straightforward entry and exit signals through Fibonacci relationships. By understanding its structure, learning to identify it accurately, and applying strategic entry and exit points, traders can potentially achieve better trading results. As with any trading strategy, it’s essential to combine this pattern with proper risk management and other technical indicators to increase the chances of success.